Minimum wage compliance is more complex than many businesses assume. With evolving state and local ordinances, inflation-driven adjustments, and ongoing federal discussions, employers must constantly monitor and apply changes to stay compliant.

At the federal level, the Fair Labor Standards Act (FLSA) requires nonexempt employees in both private and public sectors to be paid the higher of the federal, state, or local minimum wage. As of 2025, the federal minimum wage remains $7.25 per hour, unchanged since July 2009. However, more than half of U.S. states, plus Washington D.C. and several U.S. territories, enforce higher minimum wage rates with many states introducing annual increases tied to inflation to address rising costs of living.

Which States Have Minimum Wages Higher Than the Federal Rate?

Alaska, Arizona, California, Colorado, Connecticut, District of Columbia, Delaware, Florida, Hawaii, Illinois, Maryland, Massachusetts, Maine, Minnesota, Missouri, Montana, Nebraska, New Jersey, New Mexico, Nevada, New York, Ohio, Oregon, Rhode Island, South Dakota, Vermont, Virginia, Washington

If any of your employees work in states or cities where the minimum wage exceeds the federal rate, you’re required to pay the higher applicable rate. Employers operating across multiple jurisdictions should ensure payroll systems can track and apply the correct rates consistently.

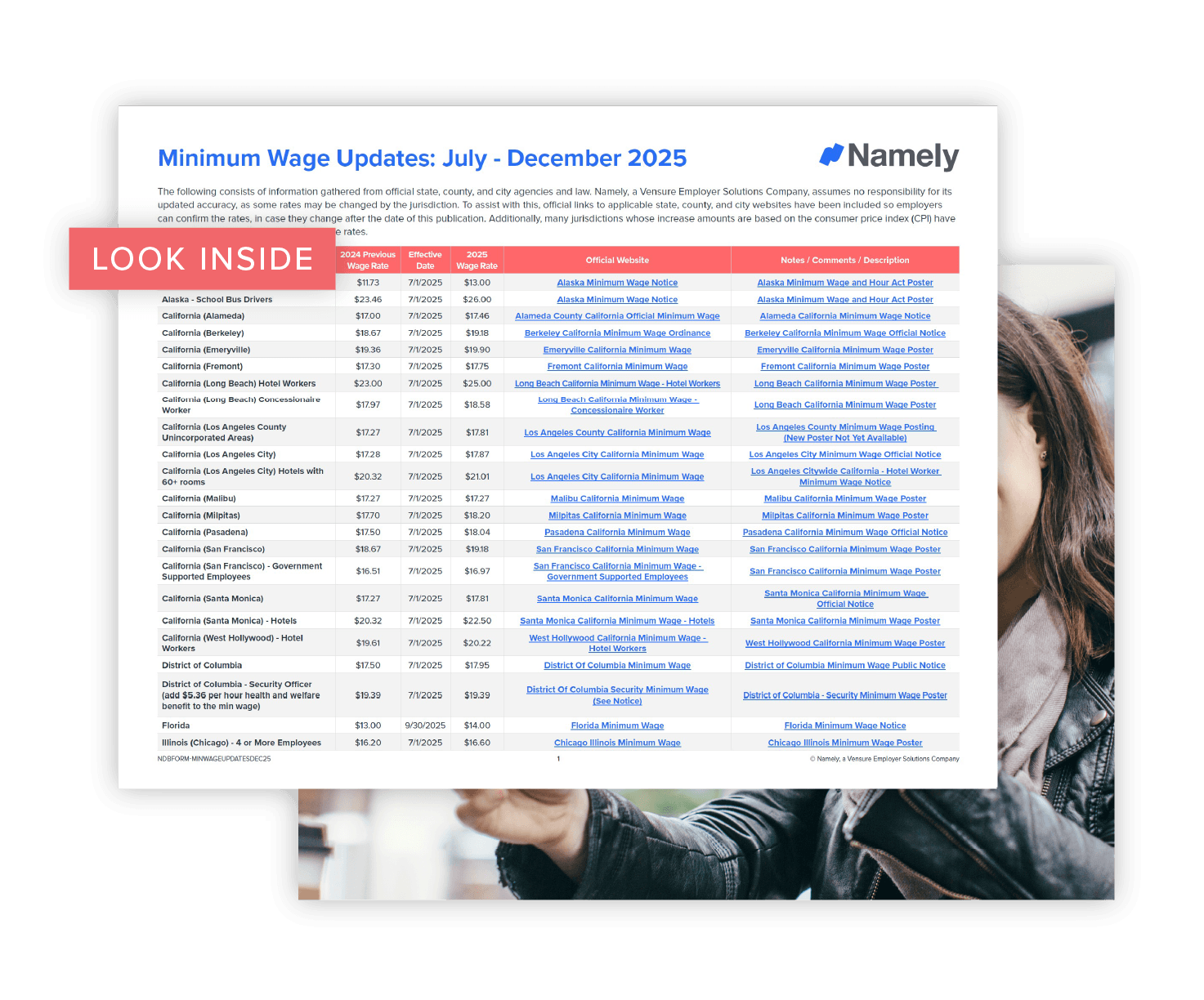

2025 Federal & State Minimum Wage Guide

Namely appreciates how hard it is to keep up with changing laws. Download our Federal & State Minimum Wage Guide to ensure you are staying compliant.

Get the Guide

Minimum Wage Rates by State: 2025

Note: Some cities and counties enforce higher rates than state baselines.

| State / Jurisdiction | 2025 Minimum Wage |

| Alabama | $7.25* |

| Alaska | $13.00 |

| Arizona | $12.80 |

| Arkansas | $11.80 |

| California (Statewide – Outside Local Jurisdictions) | $16.50 |

| California (Local Jurisdictions) | |

| Alameda | $17.46 |

| Berkeley | $19.18 |

| Emeryville | $19.90 |

| Fremont | $17.75 |

| Los Angeles (City) | $17.87 |

| Los Angeles (County – Unincorporated Areas) | $17.81 |

| Long Beach – Hotel Workers | $25.00 |

| Long Beach – Concessionaire Workers | $18.58 |

| Malibu | $17.27 |

| Milpitas | $18.20 |

| Pasadena | $18.04 |

| San Francisco | $19.18 |

| San Francisco – Government Supported Employees | $16.97 |

| Santa Monica (General) | $17.81 |

| Santa Monica (Hotels) | $22.50 |

| West Hollywood – Hotel Workers | $20.22 |

| Colorado | $12.56 |

| Connecticut | $14.00 |

| Delaware | $10.50 |

| District of Columbia | |

| General Minimum Wage | $17.95 |

| Security Officers | $19.39 (includes $5.36/hour benefits) |

| Florida | $14.00 (effective 9/30/2025) |

| Georgia | $7.25* |

| Guam | $8.75 |

| Hawaii | $10.10 |

| Illinois (Chicago) | |

| 4 or More Employees | $16.60 |

| Subsidized Temporary Youth Employment | $16.50 |

| Indiana | $7.25* |

| Iowa | $7.25* |

| Kansas | $7.25* |

| Kentucky | $7.25* |

| Louisiana | $7.25* |

| Maryland (Montgomery County) | |

| Large Employers (51+ employees) | $17.65 |

| Mid-Sized Employers (11–50 employees) | $16.00 |

| Small Employers (10 or fewer employees) | $15.50 |

| Massachusetts | $14.25 |

| Maine | $12.75 |

| Michigan | $9.87 |

| Minnesota (St. Paul) | |

| Small Businesses (6 to 100 employees) | $15.00 |

| Micro Businesses (5 or fewer employees) | $13.25 |

| Youth Workers | $12.75 |

| Mississippi | $7.25* |

| Missouri | $11.15 |

| Montana | $9.20 |

| Nebraska | $9.00 |

| Nevada | |

| Without Health Benefits | $10.50 |

| With Health Benefits | $9.50 |

| New Hampshire | $7.25* |

| New Jersey | $13.00 |

| New Mexico | $11.50 |

| New York | $13.20 |

| North Carolina | $7.25* |

| North Dakota | $7.25* |

| Ohio | $9.30 |

| Oregon | |

| Standard (Statewide) | $15.05 |

| Portland Metro Area | $16.30 |

| Nonurban Counties | $14.05 |

| Oklahoma | $7.25* |

| Pennsylvania | $7.25* |

| Puerto Rico | $8.50 |

| Rhode Island | $12.25 |

| South Carolina | $7.25* |

| South Dakota | $9.95 |

| Tennessee | $7.25* |

| Texas | $7.25* |

| Utah | $7.25* |

| Vermont | $12.55 |

| Virginia | $11.00 |

| Virgin Islands | $10.50 |

| Washington (Local Jurisdictions) | |

| Burien – Level 2 Employers (21 to 499 employees) | $20.16 |

| Renton – Mid-Size Employers (15 to 500 employees) | $19.90 |

| Everett – Large Employers (501+ employees) | $20.24 |

| Everett – Other Covered Employers | $18.24 |

| Tukwila – Mid-Size Employers | $21.10 |

| West Virginia | $8.75 |

| Wisconsin | $7.25* |

| Wyoming | $7.25* |

* States with no state minimum wage or minimum below federal. The federal rate applies.

What States Are Increasing Minimum Wage in 2025?

These are the 4 states scheduled to raise their minimum wage in 2025:

| Alaska: | $13.00 Effective July 1, 2025 |

| District of Columbia: | $17.95 Effective July 1, 2025 |

| Florida: | $14.00 Effective September 30, 2025 |

| Oregon (Statewide): | $15.05 Effective July 1, 2025 |

Note: States without updates in the guide retain their previous rates.

Cities and Counties with a Higher Minimum Wage: 2025

The following cities and counties have higher minimum wages than their state’s baseline as of mid-2025:

Alameda, California

Berkeley, California

Emeryville, California

Fremont, California

Long Beach, California (Hotel Workers + Concessionaire Workers)

Los Angeles County (Unincorporated Areas), California

Los Angeles City, California (General + Hotels 60+ rooms)

Malibu, California

Milpitas, California

Pasadena, California

San Francisco, California (General + Government Supported Employees)

Santa Monica, California (General + Hotels)

West Hollywood (Hotel Workers), California

Chicago, Illinois

Montgomery County, Maryland (Large, Mid-Sized, and Small Employers)

St. Paul, Minnesota (Small Businesses, Micro Businesses, Youth Workers)

Oregon (Portland Metro, Nonurban Counties)

Burien, Washington

Renton, Washington

Everett, Washington (Large Employers + Other Covered Employers)

Tukwila, Washington

Don’t Let Wage Changes Catch You Off Guard: Get Our Guide

With new state increases, local ordinances, and inflation-based adjustments, employers need a clear view of where—and how—rates are shifting. Whether you’re managing payroll in one location or across multiple jurisdictions, keeping up with minimum wage compliance is essential.

That’s why we have gathered the Minimum Wage Updates for July – December 2025 into a single resource that includes:

- Wage updates for 30+ states, cities, and counties

- Effective dates, tipped wage changes, and rate comparisons

- Links to official sites and jurisdiction-specific resources

Why It Matters:

Failing to comply with the correct rate—even by a few cents—can lead to penalties, back pay, and reputational damage. If you have employees in places like Los Angeles, Montgomery County, or Portland, you may be subject to different rates depending on job type, business size, or even zip code.

Grab your copy for the latest minimum wage updates and ensure your payroll stays compliant.

Minimum Wage Compliance Is Easier with Namely

Maintaining compliance with federal minimum wage laws can be confusing as minimum wage varies between states, as well as among cities, counties, and types of workers. Using a configurable human capital management (HCM) platform can streamline your payroll and tax processes with ease. This can make handling unlimited pay rates, time collection rules, and shift differentials a much easier process. Being able to update minimum wage rates by worksite and location can also be extremely beneficial for employees and employers alike.

To learn more about how a single HCM system can streamline your HR & payroll processes, check out How an Integrated HCM Platform Simplifies HR and Payroll.